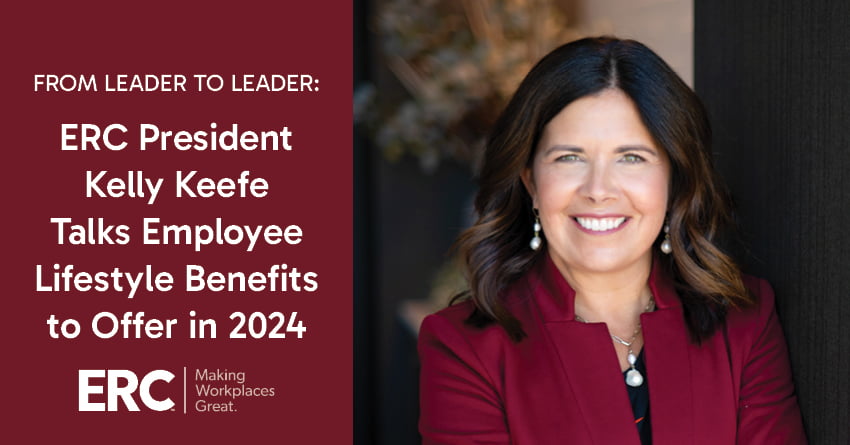

ERC President Kelly Keefe Talks Building a Talent Pipeline with Interns

Cultivating a strong candidate pipeline is essential for any organization’s long-term success. In the Northeast Ohio region alone, 88% of companies surveyed by ERC plan to build their local talent … Read more