ERC President Kelly Keefe Talks Proactive Strategies to Retain Workers

All too often, organizations are reactive in their efforts to retain their workforce. Especially during periods of talent scarcity, companies try to make quick fixes, such as increasing starting pay … Read more

From Leader to Leader: ERC President Kelly Keefe Talks Strategic Leadership in 2024

While the field of HR had already been making great strides toward putting the “human” back in Human Resources, the last few years have thrust HR into the limelight in … Read more

Are Supervisors and Managers Allowed to Yell at Employees?

What is Human Resources Certification? Comparing SHRM, HRCI, Degrees, and More

10 Crucial Skills Supervisors Need to Have

Essential Interview Questions for Hiring Supervisors: A Guide for Employers and HR Leaders

Selecting the right supervisor for your team is about more than filling a vacancy; it’s about choosing a leader who will foster growth and positivity within your team. At the … Read more

Span of Control: How Many Employees Should Your Supervisors Manage?

An Introduction to Employee Engagement Surveys

10 Things Successful Supervisors Do Differently

We’ve all had good supervisors and bad ones, and chances are, we remember the characteristics of both pretty vividly. The good ones probably stick out as people who have made … Read more

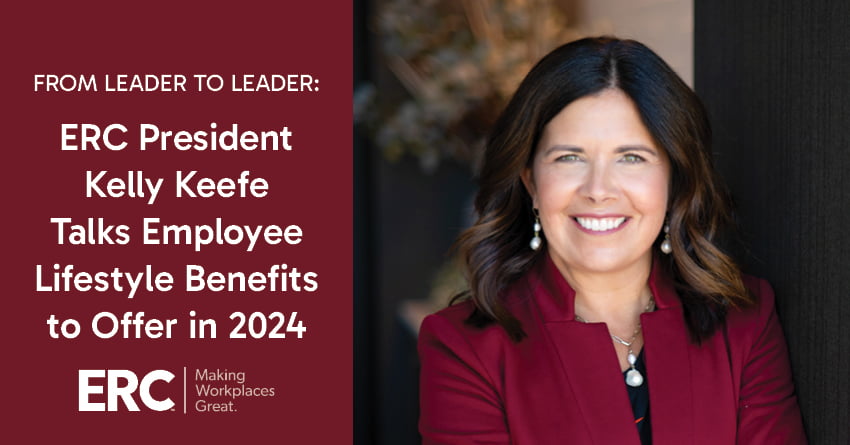

From Leader to Leader: ERC President Kelly Keefe Talks Employee Lifestyle Benefits to Offer in 2024

Since the advent of the COVID-19 pandemic, award-winning organizations have focused increasingly on offering innovative employee lifestyle benefits (also known as employee lifestyle perks) to improve the overall quality of … Read more

Effective Conflict Management Styles for Managers and Supervisors: Resolving Workplace Disputes

Workplace conflict is a common challenge that all organizations encounter. The way managers and supervisors handle workplace conflict can have a significant impact on productivity, morale, and employee retention. This … Read more